TLDR

- U.S. holds 200,000 BTC from seized assets.

- Lummis proposes gold revaluation for fiscal strategy.

- Strategic Bitcoin Reserve aims to modernize asset management.

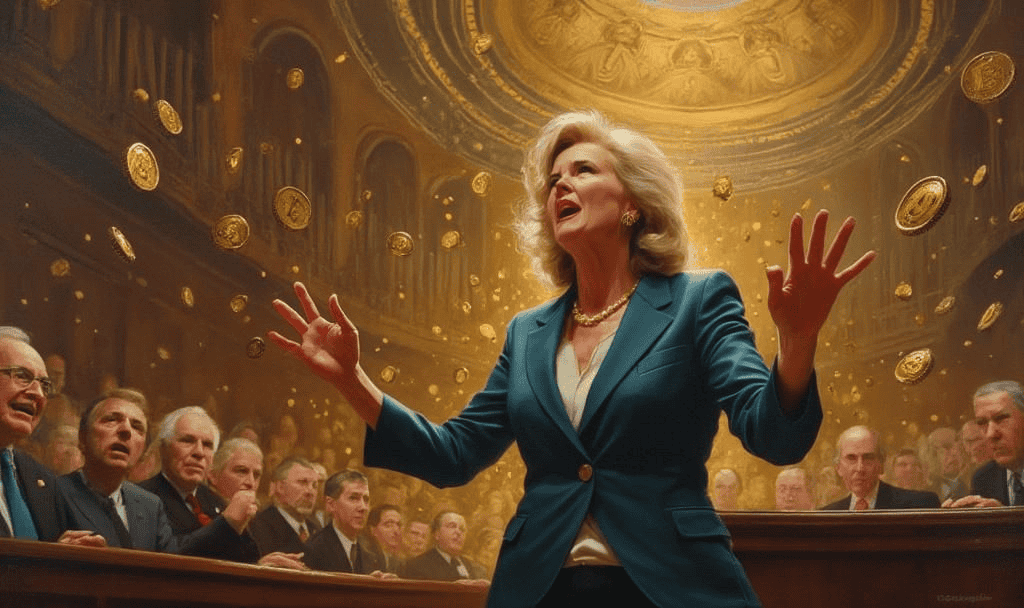

U.S. Senator Cynthia Lummis is in the midst of a debate concerning America’s soaring $37 trillion national debt. She challenges the perspective that buying more Bitcoin is a viable solution. Instead, she argues for revaluing the country’s gold reserves to fund a Strategic Bitcoin Reserve. This approach is gaining attention within financial and governmental circles as it could offer a unique method to strengthen the nation’s fiscal health without infusing additional taxpayer dollars.

The proposal is to revalue gold reserves at current market prices, alongside utilizing Federal Reserve profits and seized Bitcoin assets. This concept is aimed at creating a budget-neutral strategy, avoiding further Bitcoin purchases. Senator Lummis, known for her advocacy of digital assets, is pushing for this method as a transparent way to manage the nation’s holdings, while potentially modernizing U.S. asset strategies.

Key Figures Involved in the Policy Debate

Senator Cynthia Lummis, representing Wyoming, is spearheading the initiative. As a senior member of the Senate Banking Subcommittee on Digital Assets, she has consistently advocated for integrating Bitcoin into U.S. reserve policy. Her credentials include sponsoring multiple bills to advance crypto regulations in the U.S.

Alongside Lummis is Treasury Secretary Scott Bessent, a proponent of the Strategic Bitcoin Reserve (SBR). He suggests that leveraging existing Bitcoin assets could protect America’s fiscal future against debt and global risks. He proposed that the government halt Bitcoin sales, aiming to reduce selling pressure.

Executive Support and Legislative Actions

President Donald Trump signed an executive order in March 2025, spearheading the establishment of the Strategic Bitcoin Reserve. His administration supports broader federal digital asset strategies, reflecting his public statement about a vision for the U.S. to become the “crypto capital of the world”.

Cynthia Lummis, backing this initiative, has proposed the “BITCOIN Act,” a bill that outlines the plan for gold revaluation and transparent management of federal Bitcoin holdings. The text of this bill is available for public examination on the Senate’s official website.

Current and Future Asset Management

The U.S. government holds an estimated 200,000 BTC, primarily from assets seized in criminal cases. This makes it the largest state holder of Bitcoin, with current holdings earmarked for the Strategic Bitcoin Reserve. Federal wallets have not shown new on-chain BTC accumulation beyond seized assets.

At present, Ethereum and other alternative coins are not part of the Strategic Bitcoin Reserve. However, they are included in a separate “Digital Asset Stockpile,” which is managed at the Treasury’s discretion. Decisions about these assets could vary, impacting how digital finances are governed.

Impact on Market Conditions and Sentiment

When the Treasury halted Bitcoin sales, it potentially reduced selling pressure and supply in the market. Historically, federal asset seizures result in Bitcoin auctions, which could create market transparency yet contribute to volatility. The influence of revaluing gold reserves on market sentiment is also being keenly observed, particularly regarding fiscal strength.

Past events, such as auctions from the Silk Road case, serve as precedents for how the government might dispose of assets. Meanwhile, actions by other countries, like El Salvador’s Bitcoin reserves, have historically led to price volatility, posing additional questions for the global market.

Regulatory and Institutional Views

The Security and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC), and Treasury express cautious approaches to integrating digital assets into federal reserves. Emphasis remains on compliance and risk management as part of institutional frameworks.

Lummis’s BITCOIN Act is pending congressional action. The ongoing legislative debate will likely determine how these digital and traditional assets play into the larger picture of national debt solutions. Stakeholders across federal financial agencies are involved in shaping this evolving landscape, noted on Wikipedia.

| Disclaimer: The content on defiliban.com is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |