TLDR

- SEC Commissioner Peirce invites public feedback on crypto regulations.

- New Crypto Task Force aims to improve regulatory clarity.

- Peirce emphasizes the need for clear frameworks in crypto.

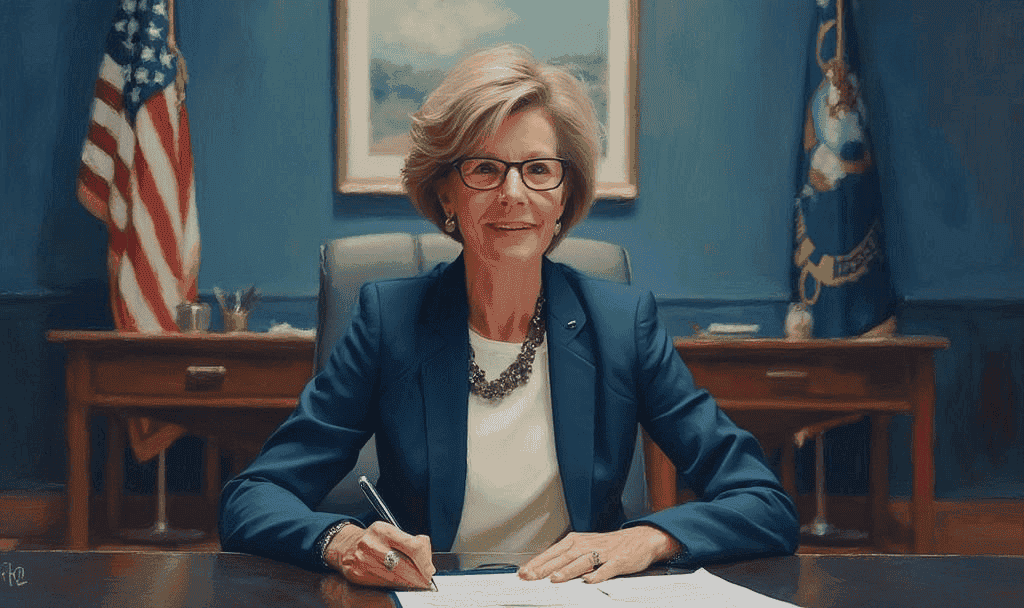

At the Bitcoin 2025 Conference, U.S. Securities and Exchange Commission (SEC) Commissioner Hester Peirce announced a significant shift in the regulatory approach towards cryptocurrency. Peirce stated that the SEC will be stepping back from actively regulating digital assets, instead inviting public input on crypto asset regulation.

Peirce’s remarks came during a discussion at the conference alongside Fold’s General Counsel, Hailey Lennon. The announcement marks a strategic move by the SEC to foster a transparent and community-informed approach, aimed at reducing regulatory uncertainty in the crypto space.

Reducing Regulatory Uncertainty

Commissioner Peirce commented on the existing regulatory landscape, noting, “One complaint I’ve had is that in an environment of regulatory uncertainty, it’s much harder to identify bad actors—and it gives them more room to operate. Meanwhile, it pushes legitimate actors out of the U.S. or out of the industry entirely. We need to create a good environment for the good actors and a bad one for the bad actors.”

Peirce emphasized the importance of establishing clear frameworks to distinguish between legitimate and fraudulent actors in the crypto industry. Her statements highlighted the need for a more predictable regulatory environment that does not stifle innovation but instead supports legitimate business operations.

Public Engagement and Feedback

As part of her address, Peirce issued an official public statement on February 21, 2025, inviting feedback on crypto asset regulation. She clarified that these questions are not a roadmap to specific actions the Commission or its staff would take, encouraging the public to address topics not explicitly raised. This call for engagement signals the SEC’s openness to constructive input from blockchain developers and crypto market participants.

In the past, Peirce has been known for her future-focused approach to securities regulations. This latest initiative continues her advocacy for thoughtful and nuanced regulation of digital assets.

Implications for Bitcoin and Altcoins

The discussion at Bitcoin 2025 directly mentioned Bitcoin (BTC) while indirectly addressing Ethereum (ETH) and other altcoins that might be impacted by security concerns in the regulatory framework. Peirce’s remarks have the potential to positively affect the sentiment surrounding large-cap digital assets.

Commissioner Peirce advised caution to investors in speculative tokens, notably stating, “If you’re expecting to buy a memecoin and become a billionaire—buyer beware. Be an adult. If you want to speculate, go for it, but if something goes wrong, don’t come complaining to the government.”

Looking Forward: SEC’s New Task Force

The SEC’s strategic shift is part of a broader initiative to evolve its regulatory approach through the recent establishment of a Crypto Task Force, as announced in January 2025. Peirce’s statements reinforce this consultative regulatory push, focusing on dialogue with crypto communities and market participants.

The creation of an official channel for public comment suggests that the SEC is committed to fostering a more predictable regulatory environment for digital assets. This move may aid in stabilizing market sentiments and bolster trust in regulatory fairness within the cryptocurrency sector.

| Disclaimer: The content on defiliban.com is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |