TLDR

- Peirce announces pause on aggressive enforcement actions.

- Regulatory uncertainty drives legitimate actors out of the market.

- New Crypto Task Force aims for comprehensive oversight framework.

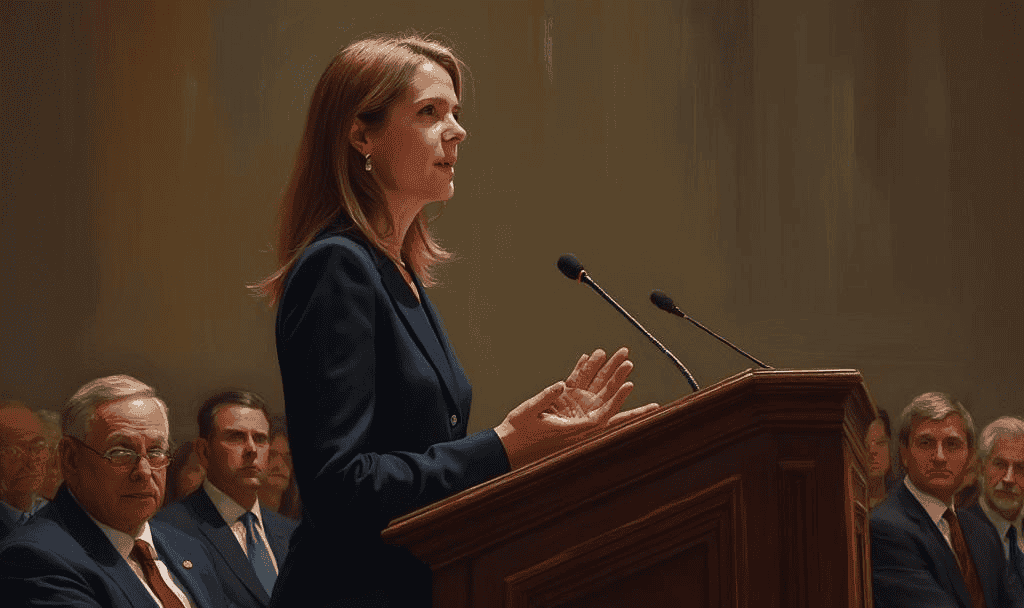

Hester Peirce, SEC Commissioner, announced a shift in the agency’s approach to cryptocurrency oversight at the Bitcoin 2025 conference. Known for her crypto-friendly stance, Peirce addressed regulatory clarity and the challenges faced by the SEC.

The announcement was made during a session moderated by Hailey Lennon, General Counsel at Fold. Peirce emphasized the complexities of developing regulations for the crypto sector and expressed a willingness to engage with industry stakeholders.

Pausing Aggressive Enforcement to Encourage Dialogue

Peirce highlighted the SEC’s current pause on aggressive enforcement actions. She remarked, “Some people have taken the fact that we haven’t moved forward with a ton of these cases as inaction—but there’s a lot to digest.” This statement reflects the agency’s strategy to better understand the evolving crypto landscape.

This approach aligns with her previous advocacy for clarifying crypto regulation and seeking input from various stakeholders. The message was clear: developing sound rules will benefit from industry dialogue. These comments were delivered in the context of Bitcoin’s unique position in the market.

“We need to create a good environment for the good actors and a bad one for the bad actors.”

Hester Peirce, SEC CommissionerRegulatory Uncertainty in the Crypto Sector

Peirce addressed the issue of regulatory uncertainty, stating that it “pushes legitimate actors out of the U.S. or out of the industry entirely.” Her remarks point out how unclear regulations can inadvertently shelter bad actors while penalizing legitimate players.

This has been a consistent theme for Peirce, reinforced by her recent public statement inviting feedback from stakeholders. She also proposed a crypto asset taxonomy aimed at increasing transparency in the development of regulations.

Peirce’s Statement on RFI Emphasizes Importance of EngagementImplications for Speculative Crypto Assets

Regarding speculative tokens, Peirce’s cautionary words resonated with those investing in risky assets. “If you’re expecting to buy a memecoin and become a billionaire—buyer beware,” she warned.

Her remarks suggest a hands-off approach for speculative investments, urging investors to accept the risk involved. While Bitcoin was the primary topic, implications extend to various altcoins, particularly memecoins popular within speculative investment circles.

Peirce Advocates Recognizing Bitcoin’s Impact in SEC TalkEngagement and Future Regulatory Framework

The SEC’s new Crypto Task Force is instrumental in shaping future regulations. It aims to build a comprehensive oversight framework and calls for broad participation from both public and institutional actors.

The task force reflects Peirce’s vision of an engaged regulatory environment, supporting her call for clarity and structured feedback. “The scope of this inquiry is expansive and calls on the particularized knowledge of a broad range of people,” Peirce emphasized.

“If you want to speculate, go for it, but if something goes wrong, don’t come complaining to the government.”

Hester Peirce, SEC Commissioner| Disclaimer: The content on defiliban.com is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |