TLDR

- BlackRock’s GIP secures an $11 billion deal with Aramco.

- Aramco holds a 51% stake in the new gas company.

- The Jafurah project aims for over $100 billion investment.

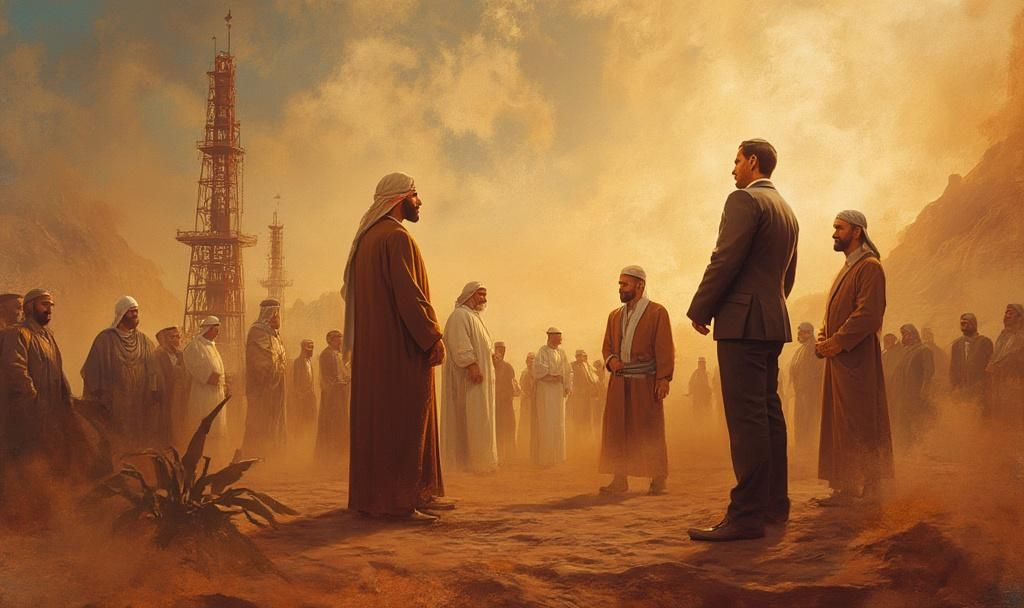

BlackRock’s Global Infrastructure Partners (GIP) has secured an $11 billion deal with Saudi Aramco for the midstream infrastructure of Saudi Arabia’s Jafurah gas field. This agreement is a 20-year lease and leaseback arrangement involving the newly formed Jafurah Midstream Gas Company (JMGC).

The deal highlights the collaboration between Saudi Aramco, the world’s largest integrated energy company, and GIP, an infrastructure investor recently acquired by BlackRock. Aramco will hold a 51% stake in JMGC, while GIP will retain 49%. This partnership underscores both companies’ commitment to expanding gas infrastructure.

Details of the Transaction and Its Structure

The deal comprises leasing, operating, and generating tariff revenue from Aramco through JMGC as part of the leaseback structure. According to Amin H. Nasser, President & CEO of Aramco, Jafurah is a cornerstone of their gas expansion program. The inclusion of GIP as investors demonstrates Jafurah’s value proposition.

The transaction will provide $11 billion in upfront proceeds to Saudi Aramco. This supports asset optimization and capital recycling. The entire Jafurah project is expected to exceed $100 billion in lifetime investment, aligning with Saudi Vision 2030 to attract foreign capital.

Sector Implications and Financial Assurances

The transaction is focused on physical energy infrastructure and not digital asset markets. It does not impact cryptocurrencies or blockchain-related assets directly. The deal includes sovereign guarantees and minimum throughput commitments, ensuring stable returns for institutional investors.

Aramco previously used similar models in oil pipelines, attracting global institutional investors and boosting market confidence in Saudi infrastructure. However, these models have not significantly impacted cryptocurrency markets.

Lack of Impact on Cryptocurrency and Web3

There is no link between the BlackRock-Aramco deal and direct impacts on major cryptocurrencies such as ETH, BTC, or related tokens. The agreement focuses on real-world assets, with no Web3, DeFi, or tokenization components involved.

No primary source Twitter or Telegram commentary from leading crypto figures has mentioned the deal. Financial regulators have not released any statements or filings in reaction to this announcement, indicating its strictly institutional nature.

“Jafurah is a cornerstone of our ambitious gas expansion program, and the GIP-led consortium’s participation as investors in a key component of our unconventional gas operations demonstrates the attractive value proposition of the project.”

Amin H. Nasser, President & CEO, Aramco| Disclaimer: The content on defiliban.com is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |